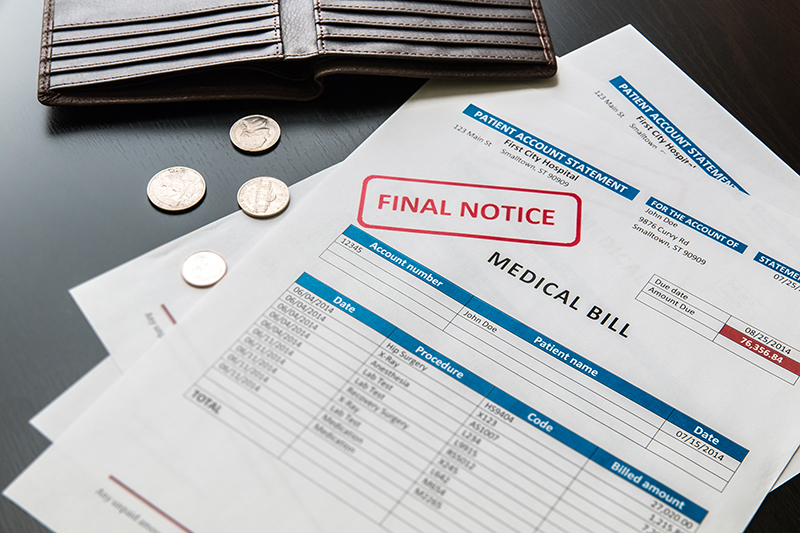

Restoring Financial Health, One Medical Debt at a Time

Medical bills shouldn’t destroy your financial future. If you’re feeling overwhelmed by unexpected healthcare costs, Richard Hughes is here to help.

Our team provides compassionate, strategic legal assistance for Longview, TX, to help you resolve medical debt and regain control of your finances.

Trusted Medical Bill Attorney in Longview, TX

Richard Hughes has years of experience helping individuals navigate the complexities of medical debt.

Whether you’re being hounded by debt collectors, considering bankruptcy, or simply unsure of your options, we’re here to guide you every step of the way with clarity, honesty, and care.

Expert Medical Debt Lawyer Services

Our team of Longview medical debt lawyers helps with a wide range of legal services for debt relief, including:

- Negotiating with healthcare providers and insurance companies

- Debt consolidation and settlement

- Medical bankruptcy

- Legal advice and guidance

Your Advocate as an Attorney for Medical Bills

As an experienced attorney for medical bills, Richard Hughes handles your case with the utmost professionalism and care. Our team tirelessly works to reduce your medical debt so you can regain control over your finances.

Compassionate and Effective Medical Debt Attorney

Dealing with medical debts can be overwhelming and draining. With our medical debt lawyer team, you can get relief with empathetic and results-driven representation to find the right solution for your financial situation.

Schedule a Free Consultation with a Medical Debt Lawyer

Regain financial freedom with the help of the right medical debt attorney in Longview, TX. Schedule a free consultation with Richard Hughes to find the best results for your financial future.

Frequently Asked Questions

What happens if I don’t pay my medical bills?

Ignoring medical bills can lead to serious consequences. Before things escalate, most healthcare providers will send reminders or offer to set up a payment plan.

If you don’t respond, your unpaid balance could be turned over to a collections agency. Once in collections, your debt may accrue additional fees and interest, and you may even face legal action.

In more severe cases, unpaid medical debt can result in wage garnishment or liens on your property.

If you’re struggling to pay, it’s important to contact your provider or seek financial counseling. You may qualify for financial assistance, charity care, or be able to negotiate a more manageable payment.

Can filing bankruptcy reduce or eliminate medical debt?

Yes, both Chapter 7 and Chapter 13 bankruptcy can reduce or eliminate medical debt, but it may not be the best solution for everyone.

That’s why it’s important to consult with an experienced bankruptcy attorney like Richard Hughes. He can help you understand your options and whether or not bankruptcy is the right choice.

If bankruptcy is the best option, it’s important to understand the differences since it will change how your debt is handled.

Chapter 7 involves liquidating assets to pay creditors and typically requires a lower income to qualify. Chapter 13, on the other hand, allows you to restructure your debt into a manageable payment plan over 3–5 years.

While you can technically file without a lawyer, having legal guidance can make the process smoother and more effective.

What are some strategies I can use to deal with medical debt?

Bankruptcy is one solution, but often, it’s not your only or best option.

You might consider setting up a payment plan directly with your provider. Many hospitals will let you spread payments over time, often interest-free for the first year, as long as you stay current.

If that’s not feasible, you may consider consolidating your bills using a personal loan or low-interest credit card.

Negotiating your bill is another path. And while you can try this on your own, hiring an attorney like Richard Hughes can help ensure better terms. A medical bill attorney can advocate on your behalf to reduce what you owe.

How can a lawyer help me negotiate my medical bills?

An attorney can relieve your stress and improve your chances of getting a fair deal.

Richard Hughes has experience working directly with healthcare providers. He can negotiate lower balances or more affordable payment terms. If needed, he can also help you settle your debt or guide you through the bankruptcy process.

Wherever you are in the process, a medical debt attorney can offer clear direction and peace of mind.

I think my medical bill is incorrect. How can a lawyer help me?

If you suspect your bill has errors, a medical debt lawyer can help by reviewing it in detail.

We’ll look for issues like duplicate charges, billing code mistakes, or incorrect insurance applications. If errors are found, we’ll work with your provider to correct them.

Can a lawyer prevent medical debt collectors from contacting me?

Yes. A lawyer can help ensure that medical debt collectors follow all legal guidelines under state and federal law.

If collectors cross the line or violate your rights, we can take action to protect you and stop the harassment.

Will resolving my medical debt help my credit score?

Yes. Resolving or correcting outstanding medical bills can help improve your credit score, especially if inaccurate charges are removed from your report.

What should I do if I’ve been sued for unpaid medical bills?

If you’ve received notice of a lawsuit over unpaid medical bills, don’t wait. Reach out to an attorney immediately.

You may have limited time to respond. Richard Hughes can help you evaluate the charges, build a defense, and negotiate a solution that protects your finances and your future.